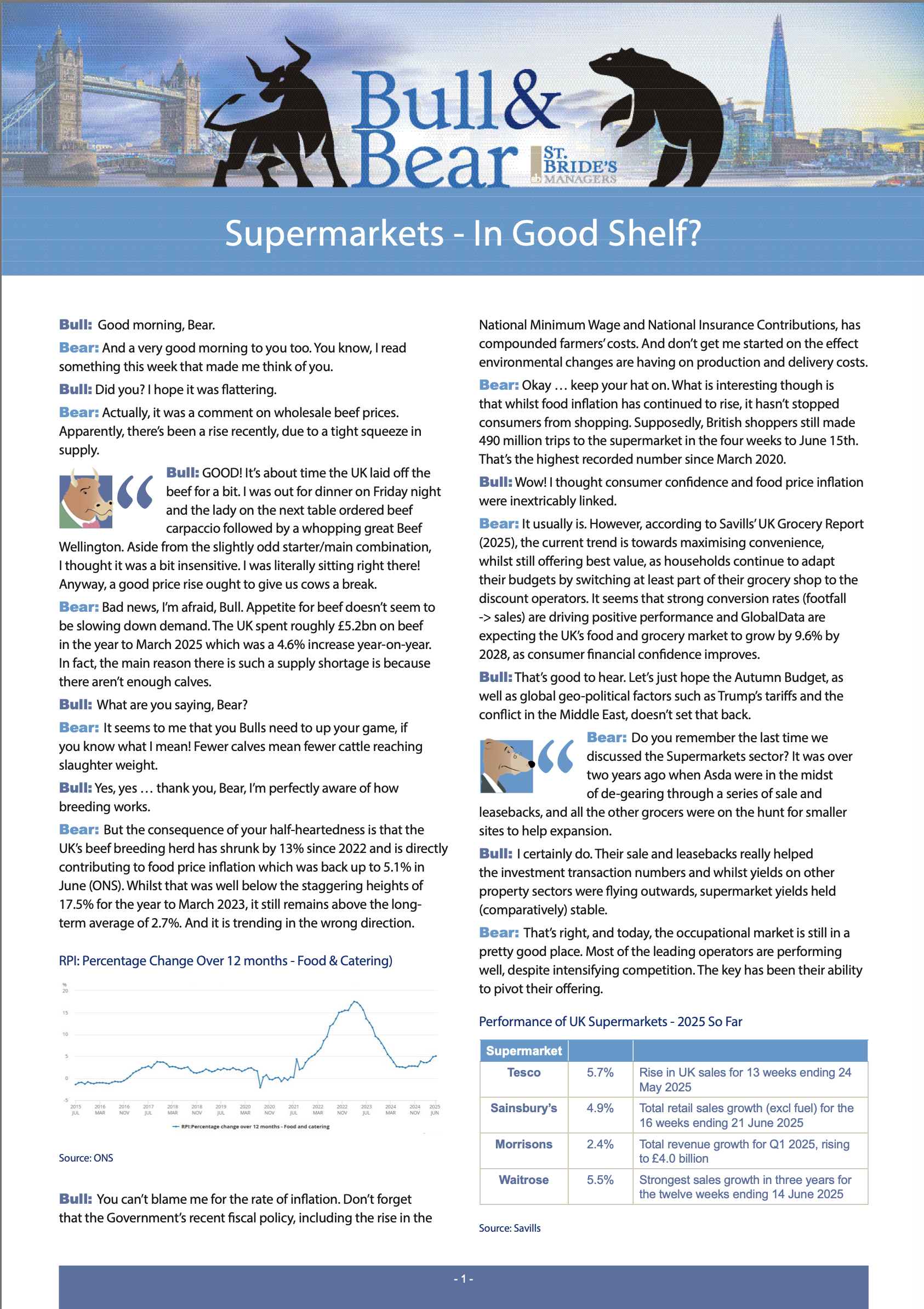

I always look forward to the Sunday morning drop in my inbox of the St Brides ‘ Bull and Bear series of topical property comment with their sprinkling of weekend sporting coverage coupled with the banter of the two old friends.👇This week it would seem particularly topical with supermarket sales benefitting from the resilience of consumers’ appetite for their weekly shop and need for convenience, despite food and drink price inflation running at over 5% as at June this year. This and the persistence of energy inflation will be of concern to the Bank of England’s meeting in 10 days’ time but a softening jobs market may well mean that the Governor, Andrew Bailey, who is known to be sensitive about a pronounced slowdown, could expect to seek the Committee’s view for a faster pace of monetary easing.

This weekend’s column discusses the difficulty of accessing food store investments and offers an indirect property solution as an alternative. But there is another way. With the planning system broken and build costs still high there is a back log of sites with AFLs to the food operators. A small pipeline of forward funding opportunities is beginning to trickle through at discount levels to an up and built store often at 20%. I can think of no other prime property investment which currently has such a deep discount and yet upon PC and lease completion is getting an immediate revaluation by such a margin. Yes, there is development risk but this is the smart way into the sector with an experienced developer, strong contractor and good drafting of a funding agreement. These opportunities frequently have the added appeal of CPI inflation linked rent reviews contributing to their defensive annuity income on long leases.

The economy shows little visibility of anything but anaemic growth and yet consumers are showing they are untouched by macro economic pressures for groceries . Despite food retailing being a low margin business expect discounting and promotion to maintain their loyal customer base which will only help consumers further should economic conditions weaken further.

The food store funding gap is wider than I can ever remember. You may not be able to access your SPARKS shopping points quite so easily just now but M&S sales are widely expected by analysts to bounce back aggressively following this year’s earlier cyber disruption. I expect investors’ behaviour to demonstrate this too as they see value, frustrated by lack of product, and therefore causing the funding gap to close. This moment gives an excellent first mover advantage for investors keen to access foodstore investments via development and should be put in their shopping list.